Perfectionism. The word that breaks or makes a person strive to reach the top of their game.

The post How to Let Go of Perfectionism to Succeed Faster appeared first on Addicted 2 Success.

Perfectionism. The word that breaks or makes a person strive to reach the top of their game.

The post How to Let Go of Perfectionism to Succeed Faster appeared first on Addicted 2 Success.

Consumer spending was flat in September as prices moved sharply higher and the Federal Reserve implemented higher interest rates to slow the economy, according to government figures released Thursday.

Retail and food services sales were little changed for the month after rising 0.4% in August, according to the advance estimate from the Commerce Department. That was below the Dow Jones estimate for a 0.3% gain. Excluding autos, sales rose 0.1%, against an estimate for no change.

Considering that the retail sales numbers are not adjusted for inflation, the report shows that real spending across the range of sectors the report covers retreated for the month.

A Bureau of Labor Statistics report Thursday indicated that consumer prices rose 0.4% including all goods and services, and 0.6% when excluding food and energy.

Miscellaneous store retailers saw a decline of 2.5% for the month, while gasoline stations were off 1.4% as energy prices declined.

A slew of other sectors also posted drops, including sporting goods, hobby, books and music stores as well as furniture and home furnishing stores, both of which posted a -0.7% drop, while electronics and appliances were off 0.8% and motor vehicle and parts dealers fell 0.4%.

General merchandise store sales rose 0.7%. Gainers also included online stores, bars and restaurants, clothing retailers and health and personal care stores, all of which saw 0.5% increases.

While the gains for the month were muted, retail sales rose 8.2% from a year ago, matching the rise in the consumer price index. Shoppers remain generally flush with cash though there are indications of late that they are dipping into savings to make ends meet.

The Fed has enacted multiple interest rate hikes aimed at reducing inflation and bringing the economy back into balance. Markets expect the central bank to raise rates up to 1.5 percentage points more through the end of the year.

A separate report Thursday showed that import prices fell 1.2% in September, slightly more than the 1.1% estimate. Exports declined 0.8%.

Get CyberSEO Lite (https://www.cyberseo.net/cyberseo-lite) – a freeware full-text RSS article import plugin for WordPress.

Inthis blog post,When you want to create a visual identity for your organization, graphic design can play a crucial role. It not only helps you create a structure for your message, but also ensures your audience recognizes your brand over time.

The post Create a Visual Identity For Your Org With Graphic Design appeared first on Entrepreneurship Life.

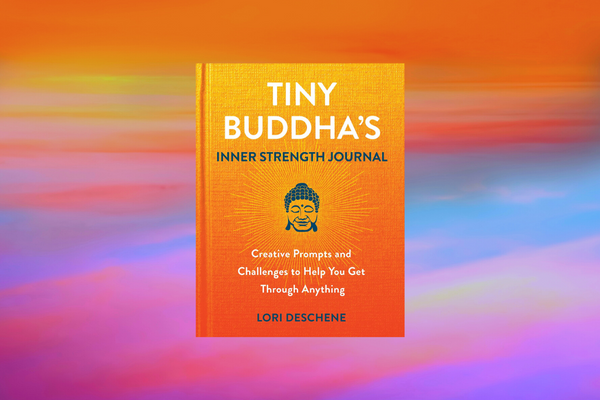

Hi friends! Today, I’m running a giveaway for my new Inner Strength Journal.

I created this journal because I know life isn’t easy for any of us.

Maybe you’re in a dark place right now, perhaps healing from trauma, …

The post Giveaway: New Inner Strength Journal – A Tool to Help You Get Through Anything appeared first on Tiny Buddha.

Melanie Musson, a car insurance expert with CarInsuranceComparison.com, which provides insurance education and offers insurance premium comparisons joins Enterprise Radio.

The post The Importance of Choosing the Right Car Insurance for Your Business appeared first on Enterprise Podcast Network – EPN.

“Brute force crushes many plants. Yet the plants rise again. The Pyramids will not last a moment compared with the daisy.”

Prices consumers pay for a wide variety of goods and services rose more than expected in September as inflation pressures continued to weigh on the U.S. economy.

The consumer price index increased 0.4% for the month, more than the 0.3% Dow Jones estimate, according to the Bureau of Labor Statistics. On a 12-month basis, so-called headline inflation was up 8.2%, off its peak around 9% in June but still hovering near the highest levels since the early 1980s.

Excluding volatile food and energy prices, core CPI was even higher for the month, accelerating 0.6% against the Dow Jones estimate for a 0.4% increase. Core inflation was up 6.6% from a year ago, the biggest 12-month gain since August 1982.

The report initially rattled financial markets, with stock market futures plunging and Treasury yields moving up as traders priced in likely more aggressive interest rate hikes ahead from the Federal Reserve. However, those earlier losses reversed in morning trading, and the Dow Jones Industrial Average rose more than 800 points by 1:30 p.m. ET.

“The Federal Reserve has made it very clear they’re committed to price stability, they’re committed to reducing the inflationary pressures,” said Michelle Meyer, chief U.S. economist at the Mastercard Economics Institute. “The more inflation comes in above expectations, the more they’re going to have to prove that commitment, which means higher interest rates and cooling in the underlying economy.”

Another large jump in food prices boosted the headline number. The food index rose 0.8% for the month, the same as August, and was up 11.2% from a year ago.

That increase helped offset a 2.1% decline in energy prices that included a 4.9% drop in gasoline. Energy prices have moved higher in October, with the price of regular gasoline at the pump nearly 20 cents higher than a month ago, according to AAA.

Closely watched shelter costs, which make up about one-third of CPI, rose 0.7% and are up 6.6% from a year ago. Transportation services also showed a big bump, increasing 1.9% on the month and 14.6% on an annual basis. Medical care services costs rose 1% in September.

The rising costs meant more bad news for workers, whose average hourly earnings declined 0.1% for the month on an inflation-adjusted basis and are off 3% from a year ago, according to a separate BLS release.

Inflation is rising despite aggressive Federal Reserve efforts to get price increases under control.

The central bank has raised benchmark interest rates 3 full percentage points since March. Thursday’s CPI data likely cements a fourth consecutive 0.75 percentage point hike when the Fed next meets Nov. 1-2, with traders assigning a 98% chance of that move.

The chances of a fifth straight hike three-quarter point hike also are rising, with futures pricing in a 62% probability following the inflation data.

Inflation rose despite pullbacks in some key areas that policymakers are watching.

For instance, used vehicle prices fell 1.1% and apparel posted a 0.3% decline. Egg prices even dropped, off 3.5% for the month though still up 30.5% from a year ago.

However, air fares rose after consecutive monthly declines, rising 0.8% for the month and up 42.9% from a year ago.

How much the higher prices have hurt consumers could be made clearer Friday, when the Commerce Department and Census Bureau release September’s retail sales report. The data, which is not adjusted for inflation, is expected to show a monthly increase of 0.3%, and no change when excluding auto sales.

Meyer, the Mastercard economist, said consumer spending remains solid despite the inflationary pressures.

“Inflation is able to run this hot in part because consumers have had very strong purchasing power,” she said. “Consumers are still spending through these inflation increases, and the challenge therefore is larger for the Fed to effectively be able to rebalance the economy.”

Falling housing prices eventually will work their way through to rents, which will lower the overall inflation numbers, Meyer added.

Consumer spending has held up in part because of leftover stimulus funds from Covid-related spending and a labor market that has been resilient even as the economy has slowed considerably. Nonfarm payrolls rose 263,000 in September and the unemployment rate fell to 3.5%, tied for the lowest since late-1969.

Jobless claims for the week ended Oct. 8 totaled 228,000, an increase of 9,000 from the week before, the Labor Department reported Thursday. That was just slightly ahead of the 225,000 estimate but still an indicator that layoffs are low.

Get CyberSEO Lite (https://www.cyberseo.net/cyberseo-lite) – a freeware full-text RSS article import plugin for WordPress.

Dewayne Hart, a recent author of a new book called Cybersecurity Mindset, a 20-year veteran of the US Navy and owner of a consulting firm named SEMAIS joins Enterprise Radio.

The post Why Do We Need A Cybersecurity Mindset? appeared first on Enterprise Podcast Network – EPN.

“To be yourself in a world that is constantly trying to make you something else is the greatest accomplishment.” ~Ralph Waldo Emerson

The world has a preference for the extroverted among us. In school we learn public speaking, and we …

The post A Simple Guide for Introverts: How to Embrace Your Personality appeared first on Tiny Buddha.

A haunting invitation to reckon with the relationship between nature and human nature, consumption and creativity, and the mind’s indomitable capacity for playful wonderment.