Lear Capital has acquired an 80.39-ounce gold bar that was assayed in 1933 — tested to determine its ingredients and quality — by Léo Matthey,

Category: Economy

The rise of e-commerce has transformed the way businesses operate and connect with customers worldwide. Online marketplaces have become increasingly popular for entrepreneurs seeking to

As companies undergo periods of transition, such as mergers and acquisitions, leadership changes or financial restructuring, they often require a temporary solution to fill the

When considering physical precious metal asset-based investments, investors sometimes home in on gold — but another precious metal option can also potentially offer positive returns,

Choose the Right MSSP: Not All MSPs are Equal The managed services provider (MSP) industry is growing, with many companies offering cybersecurity solutions to small

Anxiety over the cost of living and the direction of the economy could prove costly to President Joe Biden and his fellow Democrats in Tuesday’s election.

Recent surveys show consumer sentiment has risen only modestly and remains well below where it was a year ago, when inflation worries first began to grip policymakers, shoppers and business executives.

A report released Friday outlined the problem for Washington’s current ruling party. The University of Michigan, which releases a closely watched sentiment survey each month, asked respondents who they trusted more when it came to the economy and which would better for personal finances.

The result: overwhelmingly Republican.

The survey of 1,201 respondents saw Republicans with a 37%-21% edge on the question of which party is better for the economy. While that left a wide swath — 37% — of consumers who don’t think it makes a difference, the disparity of those with a preference is huge. (The survey did not distinguish whether respondents were likely voters.)

In fact, among all demographics, the only one in the Democrats’ favor was the sole party group. Whether it was age, household income or education, all other groups favored the GOP.

On overall sentiment, the Michigan survey saw a reading of 59.9 for October, 2.2% better than September but 16.5% below the same period a year ago. The reading is just off its all-time low in June 2022 and is running close to its lowest level in more than 11 years, according to data that goes back to 1978.

“It’s a huge problem” for Democrats, said Greg Valliere, chief U.S. policy strategist at AGF Investments, who specializes on the impact of politics on the financial markets. “They’ve seen enough evidence since Labor Day showing how the economy dwarfs every other issue, but they didn’t do anything about it. They didn’t say the right thing, they didn’t show enough empathy. To me, this was a really sorry performance.”

Valliere thinks the issue could get so large that Biden may have to announce soon that he will not seek a second term in 2024.

“I think the Democrats have a lot of problems right now,” he added.

Consumer confidence also hit an all-time low on housing, with just 16% of respondents saying they think now is a good time to buy, according to a Fannie Mae survey that goes back to 2011.

Those types of readings have not boded well for the party in power.

Former President Donald Trump lost his bid for reelection in 2020 when the Michigan poll was just above its early Coronavirus pandemic low. Conversely, Barack Obama won reelection in 2012 when the survey was riding a five-year high. George W. Bush captured his bid for a second term in 2004 when sentiment was middling, but Bill Clinton triumphed in 1996 when the Michigan gauge was at a 10-year high.

As for congressional control, in the 2010 midterm election, when the Obama-Biden administration lost a stunning 63 House seats, the biggest rout since 1948, the reading was at 71.6. That was only narrowly better than the year before when the economy was still climbing out of the financial crisis.

Today, the public is particularly anxious about inflation.

After declining for two months in a row, October’s one-year inflation outlook stood at 5%, up 0.3 percentage point from September and the highest reading since July. The five-year outlook also rose, up to 2.9%, and tied for the highest level since June.

The University of Michigan survey also found respondents had more trust in Republicans when it came to the fate of their personal finances.

The GOP held a 15-point lead against Democrats in that category, including a 19-point edge among independents.

The survey showed expectations running high that Republicans will prevail in Tuesday’s election and wrest control of Congress back from Democrats.

On both the general economy and personal finance questions, Republicans did far better among those holding a high school diploma or less, with a 25-point edge in both questions. Those holding a college degree gave the GOP an 8-point edge on the economy and a 10-point advantage on personal finances.

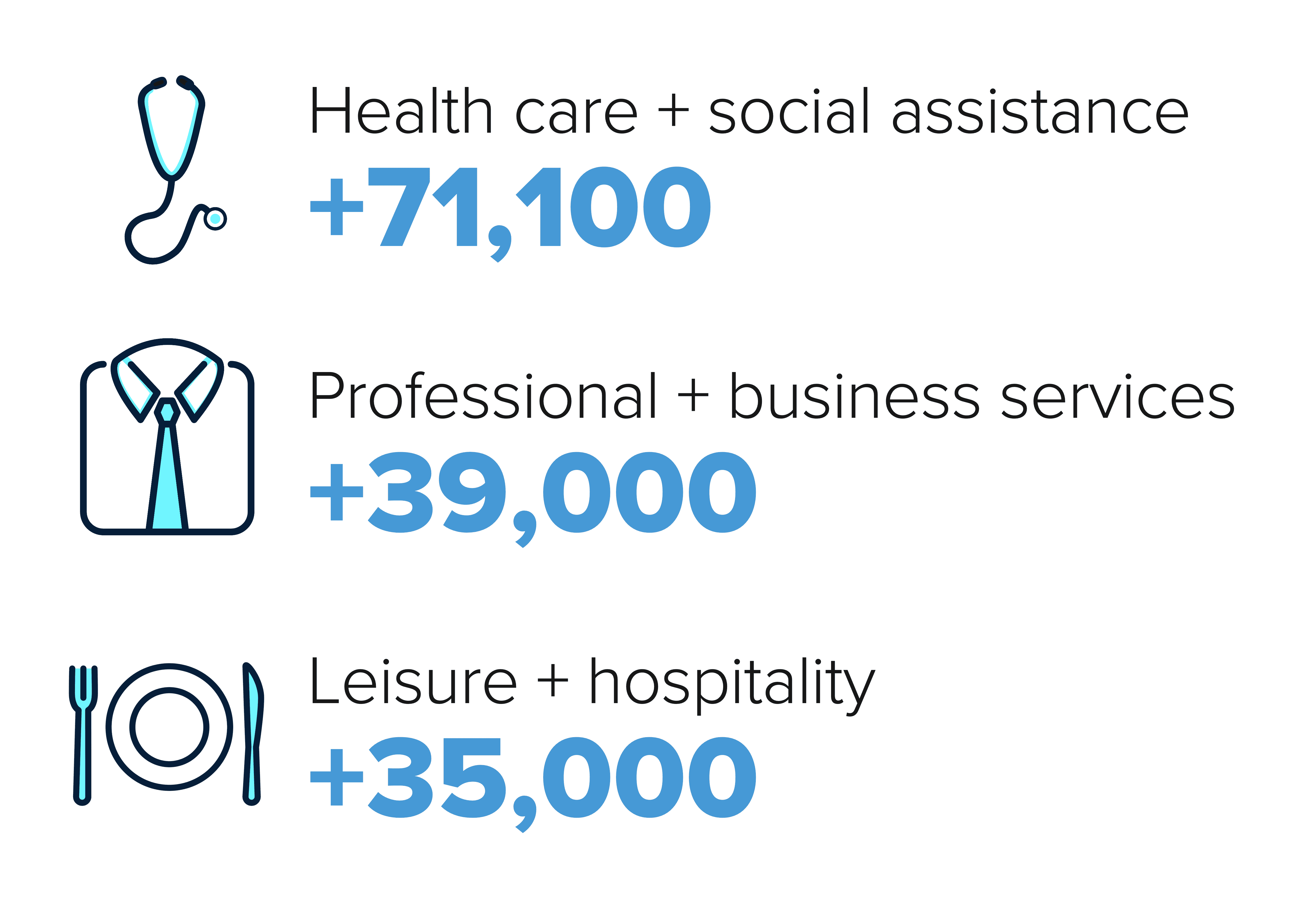

Jobs growth came in better than expected in October thanks in part to strong gains in the manufacturing, health-care, and professional and business services sectors.

Manufacturing jobs increased by 32,000 last month, boosted by gains in the durable goods industry, according to the Labor Department. That advance brought the sector’s average monthly job gain for the year to 37,000, compared with 30,000 per month in 2021.

Some market participants found the increase notable given the sharp slowdown in goods spending in the economy this year, as consumers shift more of their spending to services.

“The manufacturing gain of 32,000 suggest the economy is far from slowing in a meaningful way,” TradeStation Group’s David Russell wrote in a Friday note.

The health-care and social assistance sector also enjoyed strong gains, adding 71,100 jobs last month. By itself, the health-care sector gained 53,000 jobs in October, boosted by growth in ambulatory health-care services, as well as nursing and residential-care facilities.

According to the Labor Department, employment in health care has risen by an average 47,000 per month so far in 2022, outpacing the 9,000 jobs gains posted per month last year.

“People delayed a lot of procedures because of Covid for the last couple of years, so hip replacements and things that were somewhat optional,” said Horizon Investments’ CIO Scott Ladner. “We’re starting to see a surge of those procedures come back.”

Leisure and hospitality employment, meanwhile, continued its upward trend, adding 35,000 jobs in October. Jobs growth in the sector was mainly driven by an increase in accommodation jobs, which added 20,000 last month. Positions in restaurants and drinking establishments remained little changed, up 6,000.

The sector is still down by 1.1 million jobs, or 6.5%, from its pre-pandemic level, according to the Labor Department.

Professional and business services also was a standout sector, adding 39,000 jobs in October.

Several sectors lagged those areas in the October jobs report, however. Financial activities gained just 3,000, as employment in the sector has “changed little” over the past six months, the Labor Department said. Construction added just 1,000 jobs in October.

The retail trade sector was also little changed heading into the holiday season, adding just 7,200 jobs.

The unemployment rate for Black men ticked down in October while it rose for most other groups, but that may be because workers are dropping out of the labor force.

The October nonfarm payrolls print showed that the U.S. economy added 261,000 jobs in the month and that the unemployment rate for all workers increased to 3.7% from 3.5%.

For Black men, unemployment fell to 5.3% from 5.8% a month earlier on a seasonally adjusted basis. White unemployment rose to 3.2% overall up from 3.1% a month earlier.

“It went in the right direction for the wrong reasons,” said Bill Spriggs, an economics professor at Howard University and chief economist for the AFL-CIO.

The wrong reasons

The downward motion in unemployment for Black men is likely due to the labor force participation rate, which dipped slightly to 67.2% in October, just below the previous month’s reading of 68%.

In addition, the employment-to-population ratio for Black men fell to 63.6% from 64.1% in September, which could indicate that workers have stopped looking for jobs, sending unemployment lower.

Unemployment for Hispanic workers also jumped in October, outpacing the uptick for Black and white workers. It jumped to 4.2% from 3.8% in September.

“It’s showing this continued frustration that workers of color are having in the labor market,” said Spriggs. Though overall there is strength in the labor market, “this is not the tight labor market where people can just walk in and get a job no matter who they are.”

Overall Black unemployment ticked up led by Black women. In October, the unemployment rate for Black women jumped to 5.8% from 5.4% in September.

“This is concerning because throughout both the pandemic and the economic recovery from the pandemic crisis, Black women have been lagging behind,” said Kate Bahn, director of economic policy and chief economist at the Washington Center for Equitable Growth, a non-profit

On the brighter side, the employment to population ratio for Black women didn’t change, though labor market participation ticked up during the month. That could be a sign that more Black women are returning to the labor force and are looking for jobs but haven’t yet found employment, noted Valerie Wilson, director of the program on race, ethnicity and the economy at the Economic Policy Institute.

“It doesn’t suggest that there’s a huge number of people losing jobs,” she said.

Going forward

Of course, one month of data does not make a trend, so it’s important to look at the longer-term picture for workers of color.

Generally, the unemployment rate for workers of color has stepped down in recent months in-line with white counterparts, and labor force participation and the employment to population ratio have mostly held steady, said Wilson.

Still, there may be cause for concern going forward depending on how the Federal Reserve reads the October report. The labor market has remained strong amid historic interest rate hikes meant to tame high inflation, and the central bank is poised to continue its path of raising rates.

If the Fed goes too far and pushed the U.S. economy into a recession, that could have the worst impact on workers of color.

“If we throw the economy into a recession, that impact at least historically is more likely to hit harder in communities of color,” said Wilson.

— CNBC’s Gabriel Cortes contributed reporting.

Job growth was stronger than expected in October despite Federal Reserve interest rate increases aimed at slowing what is still a relatively strong labor market.

Nonfarm payrolls grew by 261,000 for the month while the unemployment rate moved higher to 3.7%, the Labor Department reported Friday. Those payroll numbers were better than the Dow Jones estimate for 205,000 more jobs, but worse than the 3.5% estimate for the unemployment rate.

Although the number was better than expected, it still marked the slowest pace of job gains since December 2020.

Stocks rose following the nonfarm payrolls release, while Treasury yields also were higher.

Average hourly earnings grew 4.7% from a year ago and 0.4% for the month, indicating that wage growth is still likely to serve as a price pressure as worker pay is still well short of the rate of inflation. The yearly growth met expectations while the monthly gain was slightly ahead of the 0.3% estimate.

“There has been some signs of cooling. Bur are seeing a pretty strong labor market,” said Elise Gould, senior economist at the Economic Policy Institute. “We did see a substantial increase in jobs. But there’s been a slowdown in the rate of increase. You would expect that as we get closer to full employment.”

Market pricing shifted slightly toward a 0.5 percentage point Fed rate hike in December, which would be less aggressive than the pace that began in June with 0.75 percentage point moves at each meeting. Traders expect the Fed to enact another 0.5 percentage point increase in February.

Health care biggest growth area

Health care led job gains, adding 53,000 positions, while professional and technical services contributed 43,000, and manufacturing grew by 32,000.

Leisure and hospitality also posted solid growth, up 35,000 jobs, though the pace of increases has slowed considerably from the gains posted in 2021. The group, which includes hotel, restaurant and bar jobs along with related sectors, is averaging gains of 78,000 a month this year, compared with 196,000 last year.

Heading into the holiday shopping season, retail posted only a modest gain of 7,200 jobs. Wholesale trade added 15,000, while transportation and warehousing was up 8,000.

“Job gains were fairly widespread, and overall wage gains are still too high,” said Marvin Loh, senior global macro strategist at State Street. “So, steady as she goes from a Fed perspective, but incrementally, there’s reason to have a little hope that we’re starting to see some of the froth come out of the [jobs] market.”

The unemployment rate rose 0.2 percentage point even though the labor force participation rate declined by one-tenth of a point to 62.2%. An alternative measure of unemployment, which includes discouraged workers and those holding part-time jobs for economic reasons, also edged higher to 6.8%.

September’s jobs number was revised higher, to 315,000, an increase of 52,000 from the original estimate. August’s number moved lower by 23,000 to 292,000.

The new figures come as the Fed is on a campaign to bring down inflation running at an annual rate of 8.2%, according to one government gauge. Earlier this week, the central bank approved its fourth consecutive 0.75 percentage point interest rate increase, taking benchmark borrowing rates to a range of 3.75%-4%.

Signs of slowing

Those hikes are aimed in part at cooling a labor market where there are still nearly two jobs for every available unemployed worker. Even with the reduced pace, job growth has been well ahead of its pre-pandemic level, in which monthly payroll growth averaged 164,000 in 2019.

But Tom Porcelli, chief U.S. economist at RBC Capital Markets, said the broader picture is of a slowly deteriorating labor market.

“This thing doesn’t fall of a cliff. It’s a grind into a slower backdrop,” he said. “It works this way every time. So the fact that people want to hang their hat on this lagging indicator to determine where we are going is sort of laughable.”

Indeed, there have been signs of cracks lately.

Amazon on Thursday said it is pausing hiring for roles in its corporate workforce, an announcement that came after the online retail behemoth said it was halting new hires for its corporate retail jobs.

Also, Apple said it will be freezing new hires except for research and development. Ride-hailing company Lyft reported it will be slicing 13% of its workforce, while online payments company Stripe said it is cutting 14% of its workers.

Fed Chairman Jerome Powell on Wednesday characterized the labor market as “overheated” and said the current pace of wage gains is “well above” what would be consistent with the central bank’s 2% inflation target.

“Demand is still strong,” said Amy Glaser, senior vice president of business operations at Adecco, a staffing and recruiting firm. “Everyone is anticipating at some point that we’ll start to see a shift in demand. But so far we’re continuing to see the labor market defying the law of supply and demand.”

Glaser said demand is especially strong in warehousing, retail and hospitality, the sector hardest hit by the Covid pandemic. She added that Adecco is seeing an increase in workers looking for second jobs.

The cost of labor rose less than expected, but low productivity helped keep the pressure on inflation in the third quarter, according to Labor Department data released Thursday.

Unit labor costs, a measure of productivity against compensation, increased 3.5% for the July-to-September period, below the 4% Dow Jones estimate and down from 8.9% in the second quarter.

However, productivity rose at just a 0.3% annualized rate, below the 0.4% estimate — a reflection of upward price pressures that have kept inflation running around 40-year highs.

In an effort to bring down soaring prices, the Federal Reserve on Wednesday enacted its sixth interest rate increase of the year, bringing its benchmark short-term borrowing rate to a target range of 3.75%-4%. Fed Chair Jerome Powell said he doesn’t think wage pressures have been a major contributor to inflation, though he added that the current pace is not consistent with the Fed’s 2% inflation goal.

“In such a high inflation environment, productivity growth could play a critical role in alleviating cost pressures and shielding companies against a rising wage bill,” said Lydia Boussour, senior economist at EY Parthenon. “But today’s report indicate businesses still can’t count on productivity gains to mitigate the effects of high inflation on their bottom line.”

In other economic news, the September trade deficit widened to $73.3 billion. That’s $1 billion more than expected and up from August’s $65.7 billion.

An unexpected increase in exports helped fuel a 2.6% gain in gross domestic product for the third quarter. September’s numbers, though, indicate that average exports fell $300 million, though they are up 20.2% year to date.

Labor market data released Thursday showed that the jobs picture hasn’t changed much.

Weekly unemployment insurance claims totaled 217,000 for the week ended Oct. 29, lower by 1,000 from the previous period and slightly below the 220,000 estimate. Continuing claims, which run a week behind the headline number, increased 47,000 to 1.485 million, the Labor Department reported.

At the same time, outplacement firm Challenger, Gray & Christmas reported that announced layoffs for October jumped 13% to the highest monthly rate since February 2021.

The jobs data come the day before the Labor Department releases its nonfarm payrolls report for October, which is expected to show a gain of 205,000.